Decoding SPACs : From the Startups' perspective

Startups get initial investments from angel investors and venture capital funds. However, when these startups grow and matures, the investors seek exit. The exit is mostly facilitated by going public through stock exchange listing, which helps Startups to get a broader shareholder base and a liquid market for their shares. The traditional way to go public is by way of an Initial Public Offering (IPO). An alternate pathway to go public is offered by Special Purpose Acquisition Companies (SPACs). Most of the startups are exploring the SPAC route to go public and obtain a stock exchange listing.

What are SPACs?

Special Purpose Acquisition Companies are shell or blank check companies with no underlying operating business of their own. They are legally recognized in certain jurisdictions like United States. They are incorporated especially for the purpose of undertaking any business combination transaction (merger, acquisition, etc.) with any operating business. However, they are mostly used as a vehicle to transition a privately held company to a publicly traded company, thereby bypassing the long drawn traditional IPO process.

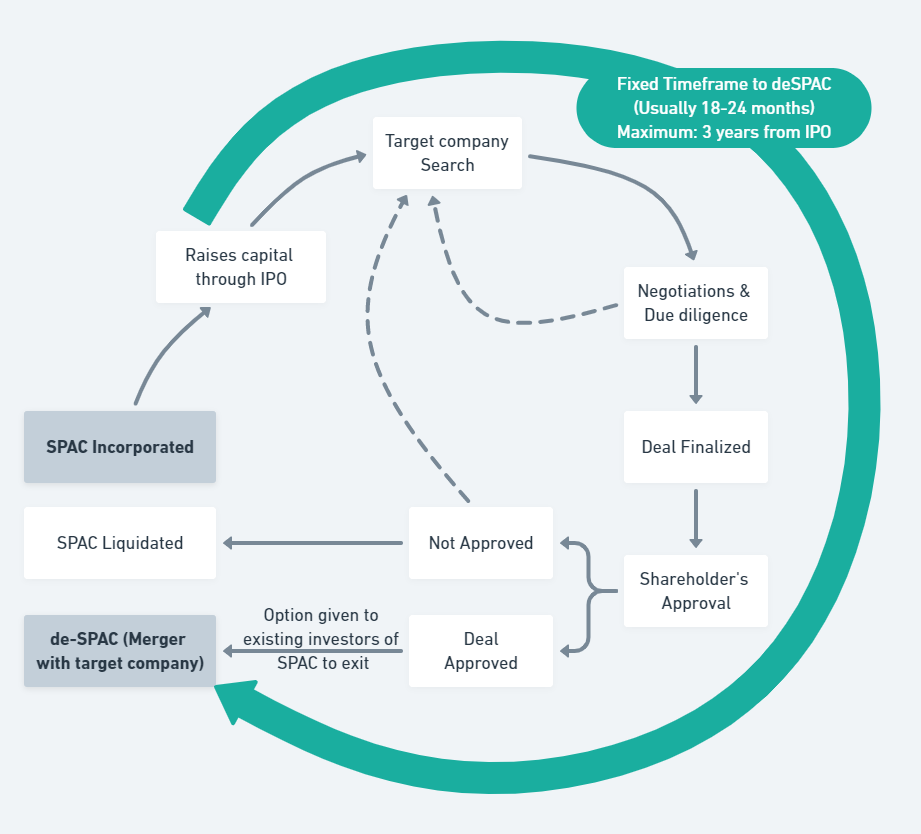

SPACs raise capital through an IPO to acquire or merge with one or more unspecified operating businesses. The business combination transaction (merger or acquisition) has to be completed within a specified timeframe (usually 18 to 24 months) but cannot exceed three years from IPO. The proceeds from the IPO has to be placed into a trust or an escrow account for future use during the acquisition. The sponsors of the SPAC identifies target company with whom the SPAC can merge. Once the target is identified, the modalities of the business combination transaction are finalized (also known as “de-SPAC” transaction). Thereafter, the transaction needs to be approved from the shareholders. Moreover, those shareholders who do not approve of the de-SPAC get the option to redeem their shares instead of becoming a shareholder in the combined company.

However, if the SPAC does not complete a business combination transaction within the specified timeframe, then the SPAC liquidates and the shareholders who are beneficiaries of the trust, becomes entitled to the pro rata share of the aggregate amount on deposit in the trust.

Key Stakeholders in a SPAC transaction

There are three important stakeholders in any combination transaction facilitated through SPAC-

- The SPAC sponsors: They incorporate the SPAC and contribute initial capital. Since SPAC does not have any operating business, it is the reputation and credibility of the sponsors which matters most during the IPO. They are mostly experienced business executives, hedge funds and private equity investment funds. Sponsors obtain a “promote”(greater equity than their cash contribution) on account of their initial commitment.

- The investors of SPAC: Those shareholders who had invested money in the SPAC through IPO or had purchased shares in the secondary market and the institutional investors. Initial investors also commonly get warrants to buy additional stock at a fixed price.

- The target: The company which finally undertakes business combination transaction with the SPAC.

How listing through SPACs is different from traditional IPO?

In the traditional IPO process, the company and its offered securities are valued through market-based price discovery whereas in a SPAC, the sponsors are solely responsible for deciding how to value the private operating company and how much the SPAC will pay for it.

Pros and Cons of listing through SPACs

The benefit of going public through SPACs are manifold-

- It takes relatively less time to go public as compared to traditional IPO route.

- The safe harbor protections for forward looking statements/projections granted under Private Securities Litigation Reform Act (PSLRA). These protects companies from any liability in private action on account of future projections/statements made during the merger process. However, this does not give a free pass to make material misstatements or omissions as SEC is empowered to take appropriate action under federal laws.

- There is no lock-in period for promoters and shareholders post listing.

- There are chances of better valuation through SPAC, especially for growth companies in the tech sector because most of them are in pre-profit (loss making) stage and it sometimes becomes difficult to get strong valuation through IPO due to restrictions on forward looking statements. Also there are better prospects of good valuation in overseas market.

- Established sponsors lend credibility to the growth story of the startups and assures the investors on account of due diligence undertaken by the sponsors. The quality of sponsors is important.

At the same time, the SEC (the securities regulator of USA) has started tightening noose around SPAC transactions in order to protect investor interests. In April 2021, SEC made changes in respect of accounting of the warrants as liability. Some experts also anticipate enhanced disclosures, dilution of safe harbor protections and lock-in periods in coming times.

From the Indian context, there are various taxation and regulatory challenges at present which needs to be addressed so as to tap the excellent opportunity to raise capital from overseas market and to reap the benefits of liquidity flush in the capital market.

Regulatory Challenges

Outbound mergers (merger of an Indian company with a foreign company) are permitted in India. Companies (Compromises, Arrangements and Amalgamation) Rules, 2016 mandates prior approval of RBI and compliance with Sections 230 to 232 of the Companies Act. RBI while considering prior approval for such outbound mergers will consider round tripping issues arising out of such mergers in respect of Indian residents.

The merger will also require prior approval from Competition Commission of India. Thereafter the amalgamation scheme also needs to be approved by NCLT.

Furthermore, non-resident shareholders of SPAC needs to adhere to FDI guidelines and the sectoral caps fixed under India’s FDI policy.

Taxation Challenges

The reverse merger of Indian company with SPAC will have tax implications.

According to Section 47 of the Income Tax Act, mergers are tax neutral for the company and its shareholders only if the amalgamated company is an Indian company. However, in case of SPACs, the amalgamated company is not an Indian company. Thus, on merger there is capital gains tax liability on both the merging company and its shareholders. More importantly, the tax burden will be higher for the Indian shareholders as compared to the foreign shareholders.

It will be important to address the disparity by suitable amendment in Income tax Act so as provide (a) tax neutrality at the time of de-SPAC/merger and (b) deferment of tax incidence on Indian shareholders till final exit from SPAC.

Why we don’t have SPACs in India?

SEBI Regulations does not allow SPACs to list on Indian stock exchanges. However, SPACs incorporated in India can list on US stock exchanges as US law permits companies incorporated outside US to be listed on its stock exchanges. Moreover, Indian law also permits overseas listing of Indian companies after amendments in Companies Act, notified in September 2020. However, detailed guidelines for overseas listing have not been formulated till date. Moreover, there are various regulatory and tax challenges which needs to be addressed.

In March 2021, SEBI has formed a group of experts under SEBI’s Primary Market Advisory Committee (PMAC) to examine the feasibility of introducing Special Purpose Acquisition Companies (SPACs) like structures in India. The International Financial Services Centres Authority (the unified authority for the development and regulation of financial products, financial services and financial institutions in the GIFT IFSC) has also released a consultation paper in March 2021 wherein IFSCA is proposing to enable a framework for listing of SPAC on the recognized stock exchanges.

Can an Indian resident invest in a SPAC?

Indian Residents can invest in overseas SPACs but the annual investment can not exceed the limits fixed under Liberalized Remittance Scheme (LRS) of the Reserve Bank of India (RBI). However, de-SPAC or business combination transaction may result in tax incidence for Indian shareholders even if they do not monetize their investments. Furthermore, Indian investors might need approval from RBI under Foreign Exchange Management Act (FEMA).

•Laws are constantly changing, either

their substance or their interpretation. Even though every attempt is made to keep the information correct

and updated, yet if you find some information to be wrong or dated, kindly let us know. We will acknowledge

your contribution.Click here to know more.

•Disclaimer: This is not professional advice. Please read Terms of Use (more specifically clauses 3 and 4) for detailed disclaimer.